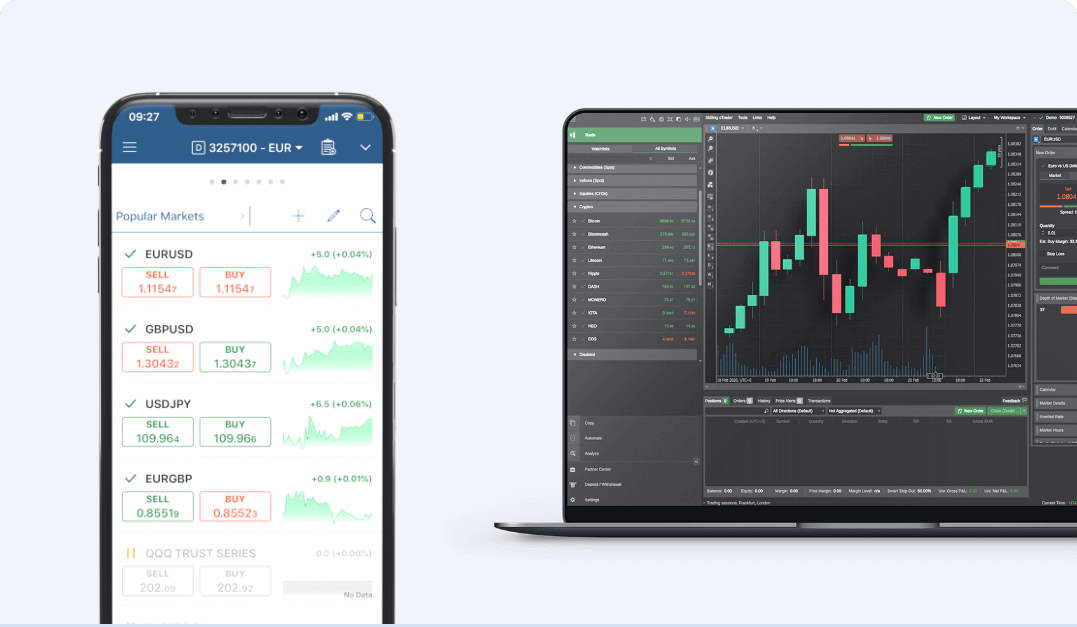

Cfd trading platform

Unfortunately, short selling in the traditional investing sense can be quite complex. You will need to arrange borrowing the stock or asset you wish to short, and you’ll need to find a buyer Versus Trade. There are also multiple fees and charges to consider.

While the CFD trading examples below will give you a great introduction to the inner workings of how you could potentially profit from CFD trading, the best way to learn is by doing. Open a free zero-risk demo account to gain access to our institutional-grade trading platform where we give you £10,000 in virtual funds to practice trading the markets with.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

Online cfd trading

Irrespective of which CFD trading market you are interested in, financial instruments change in value on a second-by-second basis. As such, it’s important to keep abreast of what is happening at all times.

Standard Accounts: These are the most common types of accounts that CFD brokers offer. They usually provide access to a wide range of financial instruments, including indices, commodities, shares, and more. The minimum deposit requirement for standard accounts can vary greatly between brokers.

FXTM, which was founded in 2011 and offers more than 1200 tradable instruments across different asset classes, is tightly regulated by the FCA in the UK and FSC in Mauritius. It offers traders a choice of platforms and competitive trading fees. Following my thorough review of FXTM, one of the standout features of the broker’s offering was its versatile mobile app.

We determined RoboForex as an excellent choice for algorithmic traders, thanks to its comprehensive offerings. They can choose between MetaTrader 4 and MetaTrader 5 platforms, both of which feature Expert Advisors (EAs) and include built-in strategy testers, allowing algorithmic traders to backtest their strategies against historical price data.

An intuitive, easy-to-navigate platform will allow you to launch into the trading world with minimal hitches. The most user-friendly platforms are typically browser-based platforms created by the broker. Look for easy-to-implement features such as watchlists, trading from the chart, search, news, and a customizable interface. MetaTrader and cTrader platforms have advanced features like backtesting, automated trading, and a wide range of order types, though they are less user-friendly.

Cfd trading meaning

With most instruments, you can hold CFDs for as long as you wish, though they are intended for short-term trading. Depending on your trading strategy, the length of time you leave a position open for could range from a matter of seconds to several months. Keeping your position open for a longer period of time may incur extra charges, such as overnight holding costs.

eToro (Europe) Ltd is listed in De Nederlandsche Bank N.V. (“DNB”) public register as a crypto service provider. DNB supervises the compliance of eToro (Europe) Ltd with the Anti-Money Laundering and Anti-Terrorist Financing Act and the Sanctions Act 1977. The crypto services of eToro (Europe) Ltd are not subject to prudential supervision by DNB or conduct supervision by the AFM. This means that financial operational risks in respect of the crypto services are not monitored and there is no specific financial consumer protection.

Tax regulations are highly country-specific. Some countries may have favorable tax treatment for certain types of financial trading, while others may impose stricter rules. Always check with local tax authorities or consult a tax professional for the most accurate information.

The buyer will offer their holding for sale should the buyer of a CFD see the asset’s price rise. The difference between the purchase price and the sale price are netted together. The net difference representing the gain or loss from the trades is settled through the investor’s brokerage account.